Since joining the WTO in 2001, China has liberated its economy and made massive changes and i think it deserves more attention than it has now. With respect to the stock market, i think it has become the leader and it pays to look out for big movements in the Shanghai Composite Index.

After a one year consolidation/fall ( depending on which time frame you would like to view it), the SSE has lost 33% from its Aug 08 peak to the Jul 09 low. I could still remember i was really surprised when market sentiment in the media turned really bearish since the start of this year when there the Chinese government decided to cool the overheated economy and introduced various measures to decrease the money supply in the Chinese economy. How is this a bad thing and how on earth can this lead to another dip in the economy when they are taking actions towards a healthy economy? Well i guess this is how it works as the media tend to over react to gain attention and publicity. This is where the aggressive contrarian steps in and make money from the ordinary 90% of the investors.

Yes one may argue that the SEE has fallen more than 20% and it has officially entered a bear market. Remember what i said about the dangers of common knowledge and using specific figures and system to trade? One should look deep into other factors as well and most important the overall economy and company earnings. I strongly believe the Chinese economy is picking up fast and this is still plenty of room for expansion. The 1 year consolidation after the more than 100% increment since the 08-09 credit crunch has definitely worked out the overbought conditions. i think the 5th of July low at 2363 will never be seen again for probably the next 1-2 years or so and we should see SSE crossing the 3000 mark by end of the year.

Next post i shall discuss the technical aspects of why i think SSE has bottomed out and take a look at one of the s-chips Yanlord which i think is raring to go.

Although China has stolen quite a bit of the limelight, i think that one should not neglect the well-watched/ well-monitored U.S.A. i would say the S&P500 and Dow remain the most watched indices and if you have been doing some intermarket analysis you would have noticed how movements in the mentioned US indices would have quite an impact on the opening of other global indices. This justifies the influence US market has over the others.

Before i go into the technical details, let's look at this from a sentimental point of view. The headlines for today's newspaper reads, "Weak outlook for US upturn. Consumer spending and incomes stay flat in June." There is no doubt that the overall sentiment remains bearish based on the media reports i have been monitoring over the past one year. And guess what, this is so after a one year increment of more than 80% in the S&P!! Up till today, there are even analysts and popular economists claiming that what took place was just a bear rally and we are still in a secular bear market. What a joke! Bear market begins only after a period of euphoria and prolonged optimism on the economy and from what i have seen over the past 1 year or so, i believe we are far from that and that is why i always feel that we have plenty of upside to go. After a one year strong rally i think it is perfectly normal for it to take a break and consolidate a little to work out the overbought conditions but time and time again the bear camp(which i think is the media and general public) would whine about how bad the economy is when the market has fallen just a few percent.

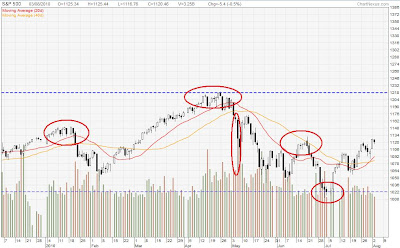

Well again i wouldn't blame the general public and ordinary investors to look out for the superficial details like the flash crash and the head and shoulders pattern( even my grandma knows about it) and trade base on them. So this is another piece of evidence that something that is widely practiced will most probably fail.

I wouldn't be the least bit surprised if the S&P500 and Dow pullbacks a little and there are articles and discussion on how the head and shoulders pattern is still valid. If that happens the aggressive and intelligent contrarian will go long at all cost.

From the market action i have observed for the past few weeks, i think the 1015.93 low made on the S&P500 will not be seen for the next 1-2 years. We should see new 52 weeks highs by end of this year/early next year.

i may be wrong but i have plenty to gain and little to lose.

No comments:

Post a Comment