Despite racking up strong gains from Friday's session(S&P), i still see no change in the general sentiment and most investors/traders still remain skeptical about the market if not more. Today's front page of Financial Times reads, " Investors braced for week of key data. Us recovery still fragile a year after it began." I can understand why most people are feeling this way and it is indeed a big concern about the health of the US economy in the future but one must be about to draw a line between the financial markets and the economy. I have been keeping good records and notice that these are the normal ingredients we would have before the market stage another move up. Judging from the bearish sentiment since the last 2-3 weeks i think we have a huge wall of worry to climb this time i would be surprised if STI ends up 200 points higher from now in the next month or so.

Nikkei: was up as much as 3% in early session but close well off the highs as the yen sore once again. This happened despite the BOJ introducing new easing measures.

Monday, August 30, 2010

Friday, August 27, 2010

Afternoon thoughts

It is a nice cooling Friday afternoon and i have the luxury and time today to stay at home and do some market watching. I really enjoy times like these and acknowledge the importance of observing the intraday price and market action. I think the knowledge gained in this process together with good record keeping is priceless. I never believe in the " 10-15 minutes work is all you need a day" promised by most "traders" and i think its total bullshit. The one and only way to be good at this game is to watch and understand it. For example, a simple observation like how the STI is holding steady at critical support levels and how the NIKKEI and SSE came back strongly in the afternoon sessions seems like bullish market action to me. All these is happening despite barrage of pessimistic data and a gloomy outlook coming from the US.

At the start of the week i went long some stocks and they are slightly in the red at the moment. I think that's perfectly fine they have yet to reach my cut loss levels but as long as they are hit, i will be ruthless and have my hard stops triggered. i think i am still at an early stage of my learning curve and especially when the kind of trading and analysis i do requires a high percentage hit rate, having a hard stop loss is vital to prevent my ego from getting the better of me. I have witness many traders/investors refusing to cut loss due to their "strong belief/ego" and in the end they are left with nothing. Mind you i take a lot of pride in my analysis due to the amount of time and work i put in everyday but i think one important rule of the game is to stay focus and not be emotional as when you become emotional that's when you fall for the mental trap.

Well one important lesson i would like to note down here is the timing of my trades. I may have nail it if the market takes off from here but could i have done better with the timing of my entries? I remember going long at the first sign of bearishness in the market and i think in today's context, as we can see right after the flash crash incident, the saying," the market can stay irrational longer than you can stay solvent" fits perfectly. In a market where 60% of the trading activity is being dominated by high speed and programmed traders, i think the EMH would cease to exist. Alright, then you may argue, one should not aspire to squeeze as much profit as possible from the trade as each and every trade varies. True, but i still think there is room for improvement and possibly i am going to make use of data and figures to aid my analysis instead of a plain artistic form of analysis by mainly using the media. To get the ball rolling, one eye popping set of numbers came in yesterday: the AAII sentiment came in at 20% bulls and 49% bears, more than a 2:1 ratio!! Moreover, we seldom get a low 20 figure and the last time we got that in early July the market was at the low and rallied 10%.

Lastly, i would like to point out this interesting article where even a technician/author that does "classical technical analysis" thinks that we are doomed and the market will run for cover.

At the start of the week i went long some stocks and they are slightly in the red at the moment. I think that's perfectly fine they have yet to reach my cut loss levels but as long as they are hit, i will be ruthless and have my hard stops triggered. i think i am still at an early stage of my learning curve and especially when the kind of trading and analysis i do requires a high percentage hit rate, having a hard stop loss is vital to prevent my ego from getting the better of me. I have witness many traders/investors refusing to cut loss due to their "strong belief/ego" and in the end they are left with nothing. Mind you i take a lot of pride in my analysis due to the amount of time and work i put in everyday but i think one important rule of the game is to stay focus and not be emotional as when you become emotional that's when you fall for the mental trap.

Well one important lesson i would like to note down here is the timing of my trades. I may have nail it if the market takes off from here but could i have done better with the timing of my entries? I remember going long at the first sign of bearishness in the market and i think in today's context, as we can see right after the flash crash incident, the saying," the market can stay irrational longer than you can stay solvent" fits perfectly. In a market where 60% of the trading activity is being dominated by high speed and programmed traders, i think the EMH would cease to exist. Alright, then you may argue, one should not aspire to squeeze as much profit as possible from the trade as each and every trade varies. True, but i still think there is room for improvement and possibly i am going to make use of data and figures to aid my analysis instead of a plain artistic form of analysis by mainly using the media. To get the ball rolling, one eye popping set of numbers came in yesterday: the AAII sentiment came in at 20% bulls and 49% bears, more than a 2:1 ratio!! Moreover, we seldom get a low 20 figure and the last time we got that in early July the market was at the low and rallied 10%.

Lastly, i would like to point out this interesting article where even a technician/author that does "classical technical analysis" thinks that we are doomed and the market will run for cover.

Sentimenter

I think we have an intermediate term selling climax here. Today's Business Times headline reads, " Moody market thinks party's over for now." But on the contrary it seems that the selling party is over for now. From a technical perspective, buyers seem to have taken over from the 1060-1065 region. If you can remember, 1065 was the low made back in May when we had the flash crash, so this number is of great significance. I think the confluence of "bad" news making the headlines and prices finding support at critical levels is a very bullish sign for the contrarian. Moreover STI seems to have hold steady in the 2920 zone and the huge consolidation seems like an area of accumulation. However, figures for the initial jobless claims have been better than expected but the market is not responding well. I think the release of the revised GDP figures tomorrow will be a market mover.

US: Initial jobless claims came in well at 473k, well short of the expected 485k.

Currency market: Euro/Dollar is back up to 1.27. Dollar rose against most of the other currencies.

Wednesday, August 25, 2010

it can't get any worse

When you have news about investors fleeing or pulling out from funds in a bull market, i take that as a very bullish contrarian sign. I remain firm in my stand though the recent changes in trend in various financial markets has gotten me baffled.

Nikkei: Down as low as 2% as exporter's stocks were hit hard by the strength of the yen. Dollar/Yen remained strong in the 85-86 region.

US: Existing home sales plunged 27.2% in July. Numbers came in at 3.83m well short of the 4.7m forecast.

10 year T-bond yield: 17 month low at 2.54%.

Tuesday, August 24, 2010

Sentimenter

I have decided to do a daily write-up on any important news and happenings so as to have a better gauge on the market sentiment.

Sentiment remains pretty bearish, as good second quarter earnings is ignored and there seems to be more focus on the lacklustre global economic outlook. There is a huge debate on how rising bond prices might be a sign of deflation, but interestingly, read this article that claims that we might have inflation instead of the quantitative easing by the US government. Also, this piece on the huge fund outflow caught my attention as in my records, this is a bullish contrarian sign. Meanwhile, the VIX is coming down near support at 22.5 and is not giving me any edge.

At the moment sentiment remains really weak and as you can see, investors are fleeing away from the equity market and volume is average. i still think that this initial skepticism and pessimism is fuel for the market to greater heights. Technically, Asian indices are holding up well and it seems to me that a base-building process is taking place. However, the situation in US seems bleak and i am paying close attention to it. I am no economist and i have no idea whether or not the poor economic data and concern about the widening gap between stocks and bonds will lead to further downside in the market. As a trader my job is to get into the market when i am allowed to and if the situation changes, i will not hesitate to cut my losses fast.

Only time will tell.

Sentiment remains pretty bearish, as good second quarter earnings is ignored and there seems to be more focus on the lacklustre global economic outlook. There is a huge debate on how rising bond prices might be a sign of deflation, but interestingly, read this article that claims that we might have inflation instead of the quantitative easing by the US government. Also, this piece on the huge fund outflow caught my attention as in my records, this is a bullish contrarian sign. Meanwhile, the VIX is coming down near support at 22.5 and is not giving me any edge.

At the moment sentiment remains really weak and as you can see, investors are fleeing away from the equity market and volume is average. i still think that this initial skepticism and pessimism is fuel for the market to greater heights. Technically, Asian indices are holding up well and it seems to me that a base-building process is taking place. However, the situation in US seems bleak and i am paying close attention to it. I am no economist and i have no idea whether or not the poor economic data and concern about the widening gap between stocks and bonds will lead to further downside in the market. As a trader my job is to get into the market when i am allowed to and if the situation changes, i will not hesitate to cut my losses fast.

Only time will tell.

Thursday, August 19, 2010

HSI

I usually do not like and advocate relying solely on technical indicators to spot profitable patterns as i believe such indicators are overused and unlike in the olden days, one would most likely have little edge in using them. However, one indicator that i have been tracking for a long time works very well with the HSI in spotting intermediate/short term bottoms. I know the above statement i have made is contradiction in terms, but making money is the name of the game. This indicator has proven itself for the past 1-2 years and coupled with my sentimental and fundamental analysis, i think we have a good buy signal.

I think HSI should hit 21800 by end of the month.

I think HSI should hit 21800 by end of the month.

Tuesday, August 17, 2010

EUR/USD

EUR/USD tested support at 1.2720 and rebounded off nicely. Right now, the daily bar is sitting nicely on the uptrend support, and the ADX shows that the selling strength is tapering off nicely.

Stochastic suggests a short term oversold situation, so the signs point towards a rebound.

Short term resistance is at 1.2870. As long as the currency can stay above, this trade is good for a short term (intra week) period. On the longer haul though, the currency is still trending down and it is likely to fall further after this retracement is complete.

Monday, August 16, 2010

Late night thoughts

Doom Gloom Boom....

and where is the Dow heading so far?

Techs are leading the pack today, and this is a good sign. Let's see how it goes.

Sunday, August 15, 2010

STI outlook

Okay i will do a quick one here before i catch the showdown between Liverpool and arsenal. I haven't been looking at much charts this weekend as most long positions have already been initiated on Friday.

I like the way how things are shaping up; the local index conveniently retrace and head downwards again after she hits key resistance in the backdrop of deteriorating outlook for world growth as unemployment and housing data in the Us remains weak and the Chinese economy has grown at its slowest rate for the past 11 months. Those who shorted last week are probably jumping for joy and looking at more downside to come next week as they have anchored their bearish view on the waves of bad news and data coming out. These people will probably hold on to their shorts and will only give up when STI hits the roof and set new highs. From a technical perspective, i am starting to see support coming in and i think the intelligent contrarian should step in here and ride the next up trend.

The only thing that's troubling me is the extreme volume we saw on last Friday's session. It can be institutions stepping in and scooping up shares which is a good thing as i think they wouldn't do so unless they think shares are now undervalue and a good chance of moving up in the near future OR retail investors buying the dip which is bad as from my experience when these investors treat every retracement as a buying opportunity chances are the upside is limited in the intermediate term. I guess is the former as like i said general sentiment is bad and most people would not have the balls and brains to long here.

I think many stocks are showing great charts and good upside potential. Pick the ones with a good risk to reward ratio.

I like the way how things are shaping up; the local index conveniently retrace and head downwards again after she hits key resistance in the backdrop of deteriorating outlook for world growth as unemployment and housing data in the Us remains weak and the Chinese economy has grown at its slowest rate for the past 11 months. Those who shorted last week are probably jumping for joy and looking at more downside to come next week as they have anchored their bearish view on the waves of bad news and data coming out. These people will probably hold on to their shorts and will only give up when STI hits the roof and set new highs. From a technical perspective, i am starting to see support coming in and i think the intelligent contrarian should step in here and ride the next up trend.

The only thing that's troubling me is the extreme volume we saw on last Friday's session. It can be institutions stepping in and scooping up shares which is a good thing as i think they wouldn't do so unless they think shares are now undervalue and a good chance of moving up in the near future OR retail investors buying the dip which is bad as from my experience when these investors treat every retracement as a buying opportunity chances are the upside is limited in the intermediate term. I guess is the former as like i said general sentiment is bad and most people would not have the balls and brains to long here.

I think many stocks are showing great charts and good upside potential. Pick the ones with a good risk to reward ratio.

Saturday, August 14, 2010

HL Asia

HL Asia is still going strong. Since 29th of August, the stock has edged higher to 3.84 before making a pullback . There is strong support at 3.66, and it is still attractive based on the last closing price of 3.71. The first target to clear is 4.32. Based on a swing setup, entry can be made above the downtrend channel at 3.74. For a longer term positional trade, a break above 3.84 should happen before an entry is made.

The recently released financial reports point towards strong growth contributions from the units in China. The 2nd quarter results reflected a stellar 98% increase from 2nd quarter 2009. The strong momentum will allow the company to continue to deliver results.

Thursday, August 12, 2010

Morning tea rant

Yes the Dow tanked and ended yesterday's session 265 points lower and most financial news agencies blame it on the rising global concerns and deteriorating outlook for world growth. But just one day ago when the Dow reverse a 140 points deficit to close slightly negative after the Fed issued its statement, they claim it was good that the Fed is being accommodative with the monetary policy and it is healthy for the economy. So which is which? What and who will you believe? Like i said earlier the market is near a top judging from a sentimental point of view and it is vulnerable to a pullback base on any kind of data. My point is that if you are making use of information from the media as part of your analysis you must be able to process it and absorb what is useful not to you but to what really might affect the financial markets.

One more thing. I have always think that all kinds of market analysis done should be clear cut and arrive at a definite conclusion. If you are the kind where you think that one should not be bias, always have a neutral view to be able to trade on both sides of the market and only trade what the market tells you and never anticipate, i think you fail to understand and most probably do not have a trading edge.

Think again, would you rather be a no-nonsense analyst that stick to your beliefs faithfully until the market proves you wrong or a half-fuck faggot that stand on the sidelines most of the time with no opinion making you prone to following the herd?

One more thing. I have always think that all kinds of market analysis done should be clear cut and arrive at a definite conclusion. If you are the kind where you think that one should not be bias, always have a neutral view to be able to trade on both sides of the market and only trade what the market tells you and never anticipate, i think you fail to understand and most probably do not have a trading edge.

Think again, would you rather be a no-nonsense analyst that stick to your beliefs faithfully until the market proves you wrong or a half-fuck faggot that stand on the sidelines most of the time with no opinion making you prone to following the herd?

Capland shorts covered

Yes i have covered all shorts from here after it hit my first target as i will not have time to monitor the market and it is always hard to play on the short side in a bull market. Yes there is more room to go but it is also equally likely that STI will pick herself up and shoot to the stars tomorrow given the strength we have seen from this index.

What's next?

For the past 2 months since the Euro/dollar found a bottom at around 1.1876 in early June, it has been leading and moving in step with the equities market.

You would have seen the 2% sell off coming if you have noticed that the euro/dollar has been breaking and making lower lows in the shorter time frame.

As mentioned earlier, the general sentiment was too bullish and a short term top is in. STI has lost about 100 points since the high made at 3043. However, notice how conveniently and easily STI has bounced off resistance from the 3030-3040 region(the last high in mid April) Stubborn shorts would most likely be initiated here betting on STI to continue trading in its range but i always believe that the seemingly obvious scenario usually turns out wrong.

I think this is just a technical correction and we won't see another more than 10% pullback. The market will jump start again once it found support.

However please note that this is just a likely scenario i have anticipated it to play out but i will not showhand. It is always good to consider the different scenarios of how the situation would play out. Long only when the market has found support.

You would have seen the 2% sell off coming if you have noticed that the euro/dollar has been breaking and making lower lows in the shorter time frame.

As mentioned earlier, the general sentiment was too bullish and a short term top is in. STI has lost about 100 points since the high made at 3043. However, notice how conveniently and easily STI has bounced off resistance from the 3030-3040 region(the last high in mid April) Stubborn shorts would most likely be initiated here betting on STI to continue trading in its range but i always believe that the seemingly obvious scenario usually turns out wrong.

I think this is just a technical correction and we won't see another more than 10% pullback. The market will jump start again once it found support.

However please note that this is just a likely scenario i have anticipated it to play out but i will not showhand. It is always good to consider the different scenarios of how the situation would play out. Long only when the market has found support.

Monday, August 9, 2010

Can you spot the bubble?

These pictures were taken on a nice warm Saturday night just outside a well-known shop selling a local drink well liked by Singaporeans known as "bubble tea".(has it already predicted its own demise?) Ever since its emergence sometime last year, this brand of bubble tea has been the talk of the town. Business has been so good that quite a number of shops have sprung up in the past few months. I have to admit that the queue was ridiculously long for a flavoured milk tea containing some cancer causing tapioca balls and the wait after my order was insane. The end product was nothing but ordinary and the first thing that came to my mind was that this is definitely a bubble in the making.

This is a classic example of a bubble in the making and it is almost identical from the once popular "Quickly" brand of bubble tea that is so 'quickly' forgotten by people. I think the problem lies with the lack of a product good enough to support its current stream of revenue and it is made worse by all the hype created by the social crowd. The crowd is something so powerful that it its sheer size lures people to join in, forming a herd and acting irrationally, often leading to the formation of a bubble.

I guess the same can be applied to any other kinds of crowds, especially investment crowds and it pays to be able to identify crowds in its early stages.

Friday, August 6, 2010

Capland still a good short

STI is pulling back this morning despite the Dow putting up another fight back session to close slightly negative. However, I have been monitoring such divergence in market strength for the past few years and conclude that it such divergences do not present me with a trading edge in the next one day or two. Meaning, some people might think that the STI is extremely weak as it fails to take into account the bullish sentiment from US markets and will have a high chance to pullback today. I won't be surprised if STI makes a U-turn and hit the roof later on in the afternoon. Nonetheless, I am looking at Capland to hit 3.98 first.

Thursday, August 5, 2010

Short Capland

After observing the market action for the entire day, i think capitaland fulfils my criteria of a good short. The above article published in today's TODAY paper reeks of bullish sentiment and you would agree with me that any ordinary person who plans to go long on this fella would do so after seeing such an article. I have no doubt that Capitaland will make new highs in the future with improving earnings as earnings is what dictates stock prices. But in the short term i think there is money to be made on the short side.

Let's see what happens over the next few days.

A Top is near.

I think we are near a top in the short term.

Today's top 30 volume has been infested by penny stocks while the blue chips are pretty much unwanted. Honestly i never like to emphasize too much on volume as part of my analysis as i feel that knowing that a volume is high or low doesn't give one an edge over others as i never believe high volume is good for further upside(look at how the stock market drifted higher on low volume during world cup) However, whenever the majority, in this case the retail investors turn bullish have balls so big to snap up penny stocks, the outstanding, intelligent contrarian would step aside knowing that there is only plenty of risk but little reward left on the table.

Although i am very much an opposition to the bull camp in the short term, that doesn't mean that i will short the market with both my fists. You see in bull market like this, it is never easy to profit on the short side. I believe many weak bears have shorted the market since mid July only to see the market grinding higher and higher everyday and now those weak bears who have converted to weak bulls and load up on the pennies will end up on the losing end again and the cycle repeats itself until their accounts go to zero. This is how the market works and this is how the majority with the herd mentality behaves and that is why 90% of traders/investors lose money. In bull market like this, the pullback will come swift and fast and when you least expect it and most likely few would be able to profit from it unless they take on big risk.

It is pretty obvious that STI is being resisted at the 3030 level and it needs to take a step back to gain more buying support. However, with strength seen in the US market but some form of short term retracement in the SSE, this divergence in market action puts STI in a tough position to make its next move. I think the market is vulnerable and it will sell off on any bad news or data. At the moment STI would probably consolidate or make a headfake higher to draw in more of the retail investors.

Today's top 30 volume has been infested by penny stocks while the blue chips are pretty much unwanted. Honestly i never like to emphasize too much on volume as part of my analysis as i feel that knowing that a volume is high or low doesn't give one an edge over others as i never believe high volume is good for further upside(look at how the stock market drifted higher on low volume during world cup) However, whenever the majority, in this case the retail investors turn bullish have balls so big to snap up penny stocks, the outstanding, intelligent contrarian would step aside knowing that there is only plenty of risk but little reward left on the table.

Although i am very much an opposition to the bull camp in the short term, that doesn't mean that i will short the market with both my fists. You see in bull market like this, it is never easy to profit on the short side. I believe many weak bears have shorted the market since mid July only to see the market grinding higher and higher everyday and now those weak bears who have converted to weak bulls and load up on the pennies will end up on the losing end again and the cycle repeats itself until their accounts go to zero. This is how the market works and this is how the majority with the herd mentality behaves and that is why 90% of traders/investors lose money. In bull market like this, the pullback will come swift and fast and when you least expect it and most likely few would be able to profit from it unless they take on big risk.

It is pretty obvious that STI is being resisted at the 3030 level and it needs to take a step back to gain more buying support. However, with strength seen in the US market but some form of short term retracement in the SSE, this divergence in market action puts STI in a tough position to make its next move. I think the market is vulnerable and it will sell off on any bad news or data. At the moment STI would probably consolidate or make a headfake higher to draw in more of the retail investors.

Crouching China Hidden America

Since joining the WTO in 2001, China has liberated its economy and made massive changes and i think it deserves more attention than it has now. With respect to the stock market, i think it has become the leader and it pays to look out for big movements in the Shanghai Composite Index.

After a one year consolidation/fall ( depending on which time frame you would like to view it), the SSE has lost 33% from its Aug 08 peak to the Jul 09 low. I could still remember i was really surprised when market sentiment in the media turned really bearish since the start of this year when there the Chinese government decided to cool the overheated economy and introduced various measures to decrease the money supply in the Chinese economy. How is this a bad thing and how on earth can this lead to another dip in the economy when they are taking actions towards a healthy economy? Well i guess this is how it works as the media tend to over react to gain attention and publicity. This is where the aggressive contrarian steps in and make money from the ordinary 90% of the investors.

Yes one may argue that the SEE has fallen more than 20% and it has officially entered a bear market. Remember what i said about the dangers of common knowledge and using specific figures and system to trade? One should look deep into other factors as well and most important the overall economy and company earnings. I strongly believe the Chinese economy is picking up fast and this is still plenty of room for expansion. The 1 year consolidation after the more than 100% increment since the 08-09 credit crunch has definitely worked out the overbought conditions. i think the 5th of July low at 2363 will never be seen again for probably the next 1-2 years or so and we should see SSE crossing the 3000 mark by end of the year.

Next post i shall discuss the technical aspects of why i think SSE has bottomed out and take a look at one of the s-chips Yanlord which i think is raring to go.

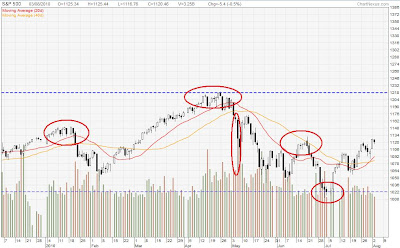

Although China has stolen quite a bit of the limelight, i think that one should not neglect the well-watched/ well-monitored U.S.A. i would say the S&P500 and Dow remain the most watched indices and if you have been doing some intermarket analysis you would have noticed how movements in the mentioned US indices would have quite an impact on the opening of other global indices. This justifies the influence US market has over the others.

Before i go into the technical details, let's look at this from a sentimental point of view. The headlines for today's newspaper reads, "Weak outlook for US upturn. Consumer spending and incomes stay flat in June." There is no doubt that the overall sentiment remains bearish based on the media reports i have been monitoring over the past one year. And guess what, this is so after a one year increment of more than 80% in the S&P!! Up till today, there are even analysts and popular economists claiming that what took place was just a bear rally and we are still in a secular bear market. What a joke! Bear market begins only after a period of euphoria and prolonged optimism on the economy and from what i have seen over the past 1 year or so, i believe we are far from that and that is why i always feel that we have plenty of upside to go. After a one year strong rally i think it is perfectly normal for it to take a break and consolidate a little to work out the overbought conditions but time and time again the bear camp(which i think is the media and general public) would whine about how bad the economy is when the market has fallen just a few percent.

Well again i wouldn't blame the general public and ordinary investors to look out for the superficial details like the flash crash and the head and shoulders pattern( even my grandma knows about it) and trade base on them. So this is another piece of evidence that something that is widely practiced will most probably fail.

I wouldn't be the least bit surprised if the S&P500 and Dow pullbacks a little and there are articles and discussion on how the head and shoulders pattern is still valid. If that happens the aggressive and intelligent contrarian will go long at all cost.

From the market action i have observed for the past few weeks, i think the 1015.93 low made on the S&P500 will not be seen for the next 1-2 years. We should see new 52 weeks highs by end of this year/early next year.

i may be wrong but i have plenty to gain and little to lose.

After a one year consolidation/fall ( depending on which time frame you would like to view it), the SSE has lost 33% from its Aug 08 peak to the Jul 09 low. I could still remember i was really surprised when market sentiment in the media turned really bearish since the start of this year when there the Chinese government decided to cool the overheated economy and introduced various measures to decrease the money supply in the Chinese economy. How is this a bad thing and how on earth can this lead to another dip in the economy when they are taking actions towards a healthy economy? Well i guess this is how it works as the media tend to over react to gain attention and publicity. This is where the aggressive contrarian steps in and make money from the ordinary 90% of the investors.

Yes one may argue that the SEE has fallen more than 20% and it has officially entered a bear market. Remember what i said about the dangers of common knowledge and using specific figures and system to trade? One should look deep into other factors as well and most important the overall economy and company earnings. I strongly believe the Chinese economy is picking up fast and this is still plenty of room for expansion. The 1 year consolidation after the more than 100% increment since the 08-09 credit crunch has definitely worked out the overbought conditions. i think the 5th of July low at 2363 will never be seen again for probably the next 1-2 years or so and we should see SSE crossing the 3000 mark by end of the year.

Next post i shall discuss the technical aspects of why i think SSE has bottomed out and take a look at one of the s-chips Yanlord which i think is raring to go.

Although China has stolen quite a bit of the limelight, i think that one should not neglect the well-watched/ well-monitored U.S.A. i would say the S&P500 and Dow remain the most watched indices and if you have been doing some intermarket analysis you would have noticed how movements in the mentioned US indices would have quite an impact on the opening of other global indices. This justifies the influence US market has over the others.

Before i go into the technical details, let's look at this from a sentimental point of view. The headlines for today's newspaper reads, "Weak outlook for US upturn. Consumer spending and incomes stay flat in June." There is no doubt that the overall sentiment remains bearish based on the media reports i have been monitoring over the past one year. And guess what, this is so after a one year increment of more than 80% in the S&P!! Up till today, there are even analysts and popular economists claiming that what took place was just a bear rally and we are still in a secular bear market. What a joke! Bear market begins only after a period of euphoria and prolonged optimism on the economy and from what i have seen over the past 1 year or so, i believe we are far from that and that is why i always feel that we have plenty of upside to go. After a one year strong rally i think it is perfectly normal for it to take a break and consolidate a little to work out the overbought conditions but time and time again the bear camp(which i think is the media and general public) would whine about how bad the economy is when the market has fallen just a few percent.

Well again i wouldn't blame the general public and ordinary investors to look out for the superficial details like the flash crash and the head and shoulders pattern( even my grandma knows about it) and trade base on them. So this is another piece of evidence that something that is widely practiced will most probably fail.

I wouldn't be the least bit surprised if the S&P500 and Dow pullbacks a little and there are articles and discussion on how the head and shoulders pattern is still valid. If that happens the aggressive and intelligent contrarian will go long at all cost.

From the market action i have observed for the past few weeks, i think the 1015.93 low made on the S&P500 will not be seen for the next 1-2 years. We should see new 52 weeks highs by end of this year/early next year.

i may be wrong but i have plenty to gain and little to lose.

Wednesday, August 4, 2010

Random Thoughts...

Yes STI has surpassed the 3000 mark again and it was accomplished via a nice uptrend on the daily chart and anyone who had bought and hold at the low in June would have made money. However, if you have been monitoring the intraday movement, you would agree with me that most traders, contra and swing traders dislike markets like this. The route up was slow and boring and volatility was at a 4 month low as seen on the ATR. Most of the time the market did closed positive but it was done via a gap up due to strength in US markets followed by little upside.

Financial markets are ever changing and there is no one way to trade the market that is why i refused to rely on indicators or adopt a systematic approach towards trading. Such indicators or the so call 'common and classical' technical analysis has been so widely practiced that i believe it is deemed useless in giving one an edge in the stock market. Unless one is able to express his own thoughts and analysis in a unique way using these indicators. So for those for are constantly searching for 'the best method/strategy/indicator', i urge you to sit back and reflect on your trading performance and whether you should change your approach towards trading the market if you are still genuinely interested.

For me i feel that my ability to gauge the market sentiment and make use of the information i have gathered and make trading decisions present me with a very strong edge over most of the other traders/investors. This is no easy tasks and there are also many other factors to consider. Still, my point is that one should be able to find an edge in the market and trade based on that strength you have and stay focused and faithful with your own abilities.

If you are still not convinced, spend some time and think about this. If 90% of traders lose money and the 10% has been making all the money from the 90%, do you think your "well planned entry, stoploss, profit target strategy" deserves to put you in the same league as the elite 10%?

Financial markets are ever changing and there is no one way to trade the market that is why i refused to rely on indicators or adopt a systematic approach towards trading. Such indicators or the so call 'common and classical' technical analysis has been so widely practiced that i believe it is deemed useless in giving one an edge in the stock market. Unless one is able to express his own thoughts and analysis in a unique way using these indicators. So for those for are constantly searching for 'the best method/strategy/indicator', i urge you to sit back and reflect on your trading performance and whether you should change your approach towards trading the market if you are still genuinely interested.

For me i feel that my ability to gauge the market sentiment and make use of the information i have gathered and make trading decisions present me with a very strong edge over most of the other traders/investors. This is no easy tasks and there are also many other factors to consider. Still, my point is that one should be able to find an edge in the market and trade based on that strength you have and stay focused and faithful with your own abilities.

If you are still not convinced, spend some time and think about this. If 90% of traders lose money and the 10% has been making all the money from the 90%, do you think your "well planned entry, stoploss, profit target strategy" deserves to put you in the same league as the elite 10%?

HL asia

As regional indices are pulling back now, let's sit back and look at some stocks in a bid to prepare for the next round.

This guy ply his trade in the raw materials and manufacturing sector and also has several subsidiaries under his arms. And as the economy progresses, companies in these sectors will move along too.

HL asia has accomplished a 12 fold increase in less than 1 year since March 09. This is no easy feat i must say. Well i have to admit i do not know much about this company fundamentally and made no attempts to look at the finances, but from a technical perspective, this stock has a huge upside potential. Traders and investors have dumped this stock during the Euro crisis and i love to pick up stocks like this. Most ordinary people might shun HL asia as they would anchor their thoughts and analysis on the steep downfall, but the aggressive contrarian will view this as a great opportunity due to the limited risk but immense reward.

Load up on HL asia if it is able to find buying interest above the 3.60-3.63 region.

This guy ply his trade in the raw materials and manufacturing sector and also has several subsidiaries under his arms. And as the economy progresses, companies in these sectors will move along too.

HL asia has accomplished a 12 fold increase in less than 1 year since March 09. This is no easy feat i must say. Well i have to admit i do not know much about this company fundamentally and made no attempts to look at the finances, but from a technical perspective, this stock has a huge upside potential. Traders and investors have dumped this stock during the Euro crisis and i love to pick up stocks like this. Most ordinary people might shun HL asia as they would anchor their thoughts and analysis on the steep downfall, but the aggressive contrarian will view this as a great opportunity due to the limited risk but immense reward.

Load up on HL asia if it is able to find buying interest above the 3.60-3.63 region.

Subscribe to:

Posts (Atom)